Cryptocurrency rehypothecation risks

Leverage magnifies exposure beyond initial capital, creating multiple layers of obligations within decentralized lending networks. When collateral is reused across several counterparties, the effective risk multiplies by times unseen in traditional finance. This amplified interconnectedness can rapidly escalate defaults from isolated events to systemic failures. The practice of reusing pledged assets increases counterparty exposure exponentially, […]

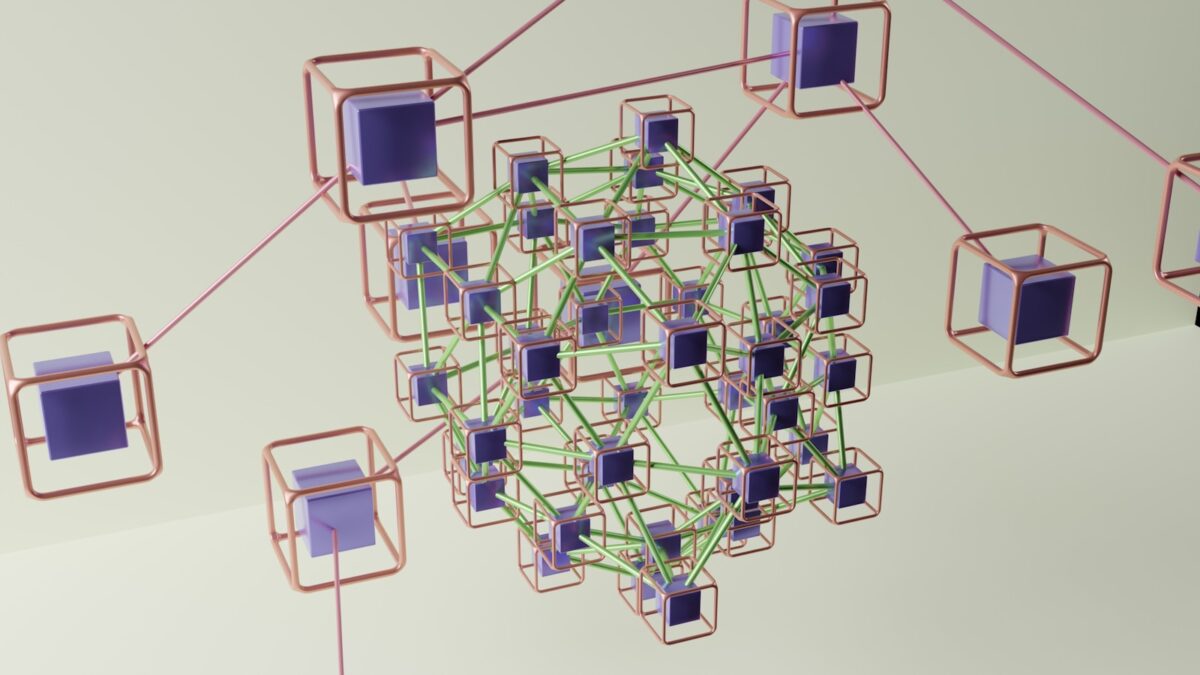

Cross-chain technology guide

To enable seamless value transfer and communication across distinct blockchain environments, adopting robust interoperability mechanisms is necessary. Bridges serve as critical infrastructure components that link multiple ledgers, allowing assets and data to move fluidly within a growing decentralized ecosystem. Evaluating the security models and consensus techniques behind these connectors is foundational for understanding their reliability […]

PayPal crypto features

Buying digital assets through this platform is streamlined but subject to specific availability constraints depending on user location. Not all cryptocurrencies are accessible for acquisition, and users should verify supported tokens before initiating purchases. The process integrates seamlessly with existing accounts, offering a straightforward entry point for acquiring virtual currencies. The system supports holding these […]

Whitepaper reading guide

Conducting due diligence requires a systematic approach to evaluating any project documentation. Begin by identifying the core problem the initiative intends to solve, then assess whether the proposed solution aligns with current market demands and technological capabilities. Prioritize clear metrics and benchmarks within the document that allow for measurable progress tracking. Effective analysis involves scrutinizing […]

Perpetual Protocol derivatives

Leverage trading becomes accessible through a decentralized mechanism that employs virtual contracts to replicate exposure without requiring actual asset transfers. This method allows traders to open positions with amplified capital, increasing profit potential while managing margin requirements efficiently. Utilizing an automated market maker (AMM) design, the system continuously provides liquidity and price discovery for these […]

IOTA internet of things

Directed Acyclic Graph (DAG) technology enables asynchronous validation of transactions, allowing machines to communicate and exchange data without the bottlenecks typical of traditional blockchains. This structure supports a high throughput environment where billions of interconnected devices can operate seamlessly. The tangle architecture eliminates the need for miners by requiring each new transaction to confirm two […]

Network analysis tools

Accurate examination of interconnected systems demands specialized software designed to parse vast amounts of on-chain data. By employing dedicated platforms that aggregate and visualize transactional statistics, researchers gain clarity on patterns otherwise obscured in raw datasets. These solutions enable tracing asset flows, identifying clustering behaviors, and quantifying node relationships with precision. Quantitative metrics derived from […]

Blockchain technology courses

Education in decentralized ledger frameworks offers a structured way to grasp the mechanisms behind trustless data management. Carefully designed modules guide learners through the architecture of immutable records, emphasizing how transactions are recorded across multiple nodes without centralized control. Understanding consensus algorithms is fundamental for anyone exploring this domain. These protocols ensure agreement among participants, […]

Cryptocurrency market makers

Liquidity facilitators play a pivotal role in maintaining tight spreads between bid and ask prices, directly influencing the efficiency of price discovery on trading platforms. By continuously quoting buy and sell orders, these entities ensure that transaction volume remains stable even during periods of high volatility, preventing excessive slippage and enabling smoother asset transfers. The […]

Crypto mixer safety

Prioritize compliance and thorough risk assessment when utilizing transaction obfuscation platforms to enhance privacy. While these tools provide enhanced anonymity by blending multiple inputs and outputs, understanding their legal status within your jurisdiction is critical. Regulatory scrutiny varies widely, so verifying that the service adheres to applicable laws reduces exposure to potential sanctions or account […]