Market sentiment indicators

Trading decisions become more precise when incorporating measures that capture the collective emotions driving price movements. An index reflecting overall psychology within financial arenas reveals shifts between fear and greed, guiding traders toward potential turning points. Monitoring these emotional fluctuations helps anticipate reversals or confirm trends beyond pure technical data.

Quantitative tools designed to assess crowd behavior quantify optimism or pessimism embedded in asset prices and volumes. For example, volatility indices often spike during panic-induced sell-offs, while breadth indicators highlight accumulation phases fueled by enthusiasm. Understanding these signals improves risk management by revealing when exuberance inflates valuations or when anxiety creates buying opportunities.

Integrating psychological metrics alongside traditional price action deepens insight into market dynamics. Recognizing dominant sentiments allows for adaptive strategies that respond to herd instincts rather than opposing them blindly. Employing such gauges sharpens timing precision, reduces exposure during irrational extremes, and enhances confidence in executing trades aligned with prevailing emotional currents.

Market Sentiment Indicators

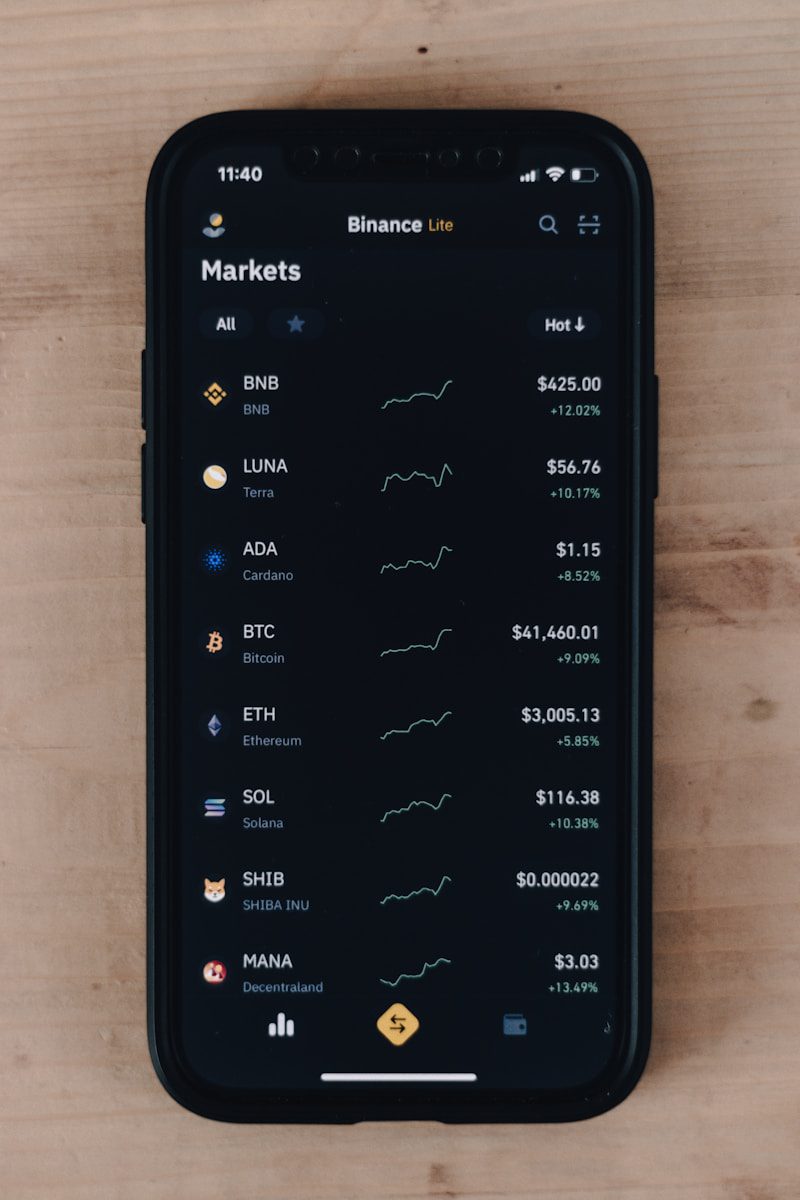

Accurate measurement of fear and greed within trading communities can significantly enhance decision-making processes. Tools such as the Fear & Greed Index quantify emotional extremes by aggregating volatility, momentum, volume, and social media trends, allowing analysts to gauge prevailing psychological states influencing asset prices. These metrics are particularly valuable in cryptocurrency markets where speculative behavior often drives rapid price swings.

Quantitative analysis of collective trader psychology involves processing data from diverse sources including order books, derivatives positions, and on-chain activity. For instance, a spike in open interest combined with elevated social media mentions may indicate growing greed-driven speculation. Conversely, a sharp decline in active addresses paired with increased volatility reflects rising apprehension among participants. This layered approach enables a nuanced understanding of behavioral dynamics behind price movements.

Key Methodologies for Tracking Emotional Dynamics

Indexes designed to capture emotional trends employ composite scoring systems integrating multiple variables:

- Volatility Metrics: Historical versus implied volatility ratios highlight uncertainty levels impacting confidence.

- Volume Analysis: Abnormal surges or drops in trade volumes signal shifts between accumulation and distribution phases.

- Social Media Sentiment: Natural language processing algorithms scan sentiments expressed across platforms to detect dominant moods.

This multifactor framework generates scores that reflect prevailing optimism or pessimism, which traders use to anticipate potential reversals or continuation patterns.

Experimental case studies demonstrate how excessive greed often precedes price corrections. For example, during the 2017 Bitcoin rally, sentiment indexes reached peak optimism aligned with record-high leverage usage and social hype. Subsequent sharp declines confirmed the utility of these psychological gauges as early warning signals. Conversely, extreme fear readings have historically marked attractive entry points for contrarian investors willing to capitalize on oversold conditions.

The interplay between emotional indicators and technical analysis tools enhances predictive accuracy. Integrating sentiment-derived indexes with trend-following strategies helps identify divergence cases where price action contradicts prevailing emotions–often signaling imminent shifts. Traders benefit from backtesting these correlations using historical datasets to refine timing precision under various market conditions.

A deeper exploration into blockchain analytics reveals on-chain metrics that complement traditional sentiment frameworks. Monitoring wallet activity concentration, token holding durations, and transfer counts provides insight into participant conviction beyond surface-level expressions of fear or greed. Such multi-dimensional evaluation fosters robust hypotheses about future price trajectories rooted in both human psychology and tangible transactional behavior.

Interpreting Volatility Index Signals

Volatility indexes quantify the expected fluctuations in asset prices by measuring implied volatility derived from options markets. A sharp rise in these indexes typically signals increased fear among participants, reflecting anticipation of abrupt price movements. Conversely, sustained low values often correspond with complacency or excessive greed, indicating a market environment where risk is underestimated. Traders and analysts should consider these dynamics to adjust their strategies accordingly.

Understanding the psychological mechanisms behind volatility index readings enhances their practical application. Elevated readings expose heightened emotional tension, where uncertainty dominates decision-making processes. Lower levels suggest confidence and reduced anxiety, but may also foreshadow overextension before corrections occur. This duality reveals a complex interplay between collective psychology and price behavior that demands nuanced interpretation beyond raw numbers.

Key Patterns in Volatility Index Movements

Analysis of historical data shows that spikes in volatility indexes often precede significant trend reversals or accelerated declines. For instance, during the 2018 cryptocurrency market correction, the Crypto Volatility Index (CVI) surged above 60 while Bitcoin’s price dropped sharply within days. Such patterns indicate an influx of panic-driven trading activity where fear outweighs rational evaluation. However, sustained high volatility can also signal persistent uncertainty rather than immediate capitulation.

On the other hand, prolonged periods of subdued index values frequently coincide with bullish trends fueled by widespread optimism and speculative buying–symptoms of unchecked greed. In mid-2020, the CVI hovered near historic lows as major digital assets rallied consistently, culminating in overheated valuations prone to sudden corrections once sentiment shifted. Monitoring divergence between price appreciation and volatility metrics offers valuable insight into potential exhaustion phases.

The use of volatility index signals extends beyond directional forecasting; they provide critical inputs for risk management frameworks in algorithmic and discretionary trading systems alike. Incorporating real-time index levels enables dynamic adjustment of position sizing or stop-loss thresholds aligned with prevailing emotional states embedded in market behavior. This method reduces exposure during panic episodes while capitalizing on calmer intervals for optimized entries.

This structured approach encourages empirical validation through backtesting strategies incorporating volatility signals alongside volume and momentum indicators. By systematically analyzing how shifts in emotional undercurrents influence trade execution outcomes, researchers can refine models capturing behavioral biases embedded within pricing mechanisms.

The integration of volatility measurements with blockchain analytics presents an exciting frontier for experimental investigation. Exploring correlations between network activity spikes and corresponding changes in implied volatility might uncover predictive relationships rooted in crowd psychology manifesting through decentralized transaction flows. These inquiries promise deeper comprehension of emergent dynamics shaping asset valuation beyond conventional financial paradigms.

Using Put-Call Ratio Data

The put-call ratio offers a quantitative measure that reflects the balance between bearish and bullish trading activity by comparing the volume of put options to call options. This ratio serves as a proxy for the prevailing psychological state among traders, revealing tendencies toward apprehension or optimism. Elevated values typically indicate heightened caution or fear, as more traders purchase protective puts, while lower ratios suggest increasing confidence or greed as calls dominate. Monitoring this metric provides actionable insight into shifts in trader expectations before they fully manifest in price movements.

In practical application, analyzing fluctuations in the put-call ratio alongside price trends enables more nuanced interpretation of market dynamics. For instance, a rising ratio concurrent with stable or rising prices may signal underlying unease despite apparent strength, hinting at potential reversals driven by growing risk aversion. Conversely, a declining ratio amid falling prices might point to capitulation phases where pessimism is peaking and contrarian buying opportunities emerge. Incorporating this data into trading strategies enhances situational awareness regarding collective trader psychology and improves timing decisions.

Technical Evaluation and Case Studies

Empirical studies demonstrate that extreme put-call ratios frequently precede significant market inflections. Historical analyses from cryptocurrency exchanges show that ratios exceeding 1.0 often correlate with intense fear periods, marking oversold conditions ripe for rebounds. Conversely, sustained readings below 0.7 align with euphoric states where greed dominates, potentially foreshadowing overheated tops vulnerable to sharp corrections. Combining these signals with volume and volatility metrics refines entry and exit points by confirming whether option positioning aligns with price momentum or diverges.

Traders can implement stepwise methodologies by first establishing baseline ranges of typical put-call ratios within specific asset classes or timeframes to define thresholds for abnormal behavior. Sequential monitoring then detects deviations signaling psychological shifts among participants. Integrating this approach with blockchain analytics–such as on-chain volume spikes or whale transaction tracking–provides multidimensional perspectives on trader sentiment evolution and emerging risk patterns. Such layered analysis supports developing robust hypotheses about forthcoming price trajectories grounded in both derivatives activity and fundamental transactional data.

Analyzing Investor Sentiment Surveys

Investor sentiment surveys provide a quantifiable reflection of prevailing emotions within financial communities, particularly highlighting the role of fear and optimism in shaping trading decisions. These surveys aggregate psychological data from participants to form an index that can forecast potential shifts in asset prices by capturing collective expectations and apprehensions.

The reliability of these psychological barometers depends on rigorous methodology, including sample size, question framing, and timing relative to market events. For instance, elevated levels of fear often correlate with oversold conditions, signaling possible buying opportunities identified through historical analysis of similar index readings.

Understanding Survey-Based Psychological Metrics

Psychological metrics derived from surveys measure trader confidence by assessing responses related to risk tolerance and anticipated trends. The VIX Index, though focused on volatility rather than direct survey input, is frequently compared with sentiment indexes for validation. Cross-referencing such data enhances analytical depth by revealing discrepancies between perceived risk and actual price movements.

Case studies illustrate how spikes in bearish sentiment precede short-term reversals. In crypto markets, sudden rises in fear indices during sharp drawdowns often precede recoveries as panic selling exhausts itself. Analyzing temporal patterns in these survey results enables traders to anticipate entry points based on crowd psychology rather than pure technical signals.

- Sentiment extremes: Identifying when survey results reach unusually high or low levels helps detect overbought or oversold states.

- Divergence analysis: Comparing sentiment indexes against price trends reveals potential trend exhaustion or continuation.

- Volume correlation: Studying trading volumes alongside survey data confirms whether emotional shifts translate into market action.

The integration of such behavioral indices into comprehensive market analysis offers predictive advantages but requires caution against confirmation bias. It is essential to validate survey outcomes with objective transaction data to avoid misinterpretation driven solely by crowd psychology narratives.

Systematic experimentation with investor mood tracking encourages a deeper understanding of how collective psychology influences cryptocurrency fluctuations. By continuously refining survey instruments and contextualizing findings within broader analytical frameworks, researchers can develop more nuanced models that enhance predictive accuracy and support disciplined trading strategies grounded in empirical evidence.

Tracking Commitment of Traders Reports

The Commitment of Traders (COT) report provides invaluable data for evaluating the positioning of various market participants, offering a measurable index that captures the balance between optimism and caution. By analyzing the net positions of commercial hedgers, large speculators, and retail traders, one can quantify prevailing emotional drivers such as greed and fear that influence price movements. This analysis reveals shifts in collective psychology, highlighting when enthusiasm may have peaked or excessive pessimism has taken hold.

Examining historical COT data alongside price trends enables identification of extremes where speculative activity diverges from fundamental valuations. For instance, a significant increase in long contracts among large speculators often signals heightened risk appetite, which can precede a corrective phase if it reaches unsustainable levels. Conversely, rising short interest may indicate mounting apprehension, potentially setting the stage for an upward reversal once selling pressure exhausts itself.

Methodologies and Practical Applications

To interpret the COT report effectively, analysts construct ratios and oscillators derived from open interest figures across trader categories. The speculative index, calculated as the proportion of longs to shorts among non-commercial players, serves as a proxy for collective greed-driven behavior. When this index reaches historically high thresholds–such as above 80%–it suggests overextension fueled by exuberance. Similarly, low values approaching 20% reflect dominant fear and capitulation phases.

A case study involving Bitcoin futures illustrates these principles: during late 2020, a surge in large speculator long positions aligned with a parabolic rally but also flagged vulnerability to rapid profit-taking. Subsequent retracements correlated with declines in speculative indices below mid-range levels. Integrating COT-derived metrics with volume analysis and volatility measures enhances predictive accuracy regarding trend durability and potential reversals.

Understanding trader psychology through commitment reports demands continuous monitoring as shifts can be abrupt yet revealing. Combining quantitative assessments with qualitative insights–such as news flow or macroeconomic developments–strengthens interpretation frameworks. This systematic approach equips analysts to anticipate turning points by recognizing when collective behavior transitions from confidence to caution or vice versa.

Conclusion: Harnessing Emotional Dynamics for Enhanced Trading Outcomes

Integrating psychological metrics related to fear and greed into trading frameworks significantly refines decision-making processes. Empirical analysis reveals that extreme emotional states often precede pivotal price reversals, allowing traders to anticipate shifts more precisely than relying solely on traditional quantitative data.

Quantifiable tools capturing collective mood fluctuations provide a nuanced layer of insight, enabling the identification of overbought or oversold conditions with greater accuracy. For instance, oscillators derived from social media sentiment indices have demonstrated predictive power in volatile cryptocurrency markets, where rapid shifts in trader psychology frequently trigger abrupt price movements.

Future Directions and Practical Implications

- Multi-source Data Fusion: Combining textual analysis from blockchain forums, on-chain metrics, and behavioral finance models will enhance the robustness of emotional state assessments.

- Algorithmic Adaptation: Machine learning systems tuned to detect patterns in collective anxiety or exuberance promise adaptive risk management strategies tailored to evolving trader moods.

- Real-time Feedback Loops: Implementing dynamic monitoring dashboards can alert traders when emotional extremes approach thresholds historically linked to trend exhaustion.

- Behavioral Cycle Mapping: Longitudinal studies tracking cyclical psychological patterns may reveal recurring phases of irrational exuberance or panic selling within crypto ecosystems.

The intersection of cognitive biases and price dynamics underscores the necessity for continuous experimental validation. By systematically quantifying affective drivers behind market actions, analysts gain a critical edge–transforming subjective intuition into actionable intelligence. This approach not only improves timing precision but also cultivates disciplined responses amid turbulence.

Exploring these analytical frontiers invites questions: How might decentralized sentiment aggregation reshape predictive models? Can real-time emotion tracking be standardized across disparate asset classes? Pursuing such inquiries deepens understanding of the interplay between human psychology and trading mechanisms, ultimately advancing both theoretical frameworks and practical applications within financial technology domains.